Casino Win Loss Statement Taxes

- Gambling Win Loss Statement Taxes

- Win Loss Statement From Casino For Taxes

- Casino Win Loss Statement Taxes

- Casino Win Loss Statement For Taxes

- Gambling Win Loss Statement Taxes

- Casino Win Loss Statement Irs

Tax Advice for Casino Players: W2-G Handpay Jackpots, Filing as a 'Pro' and More

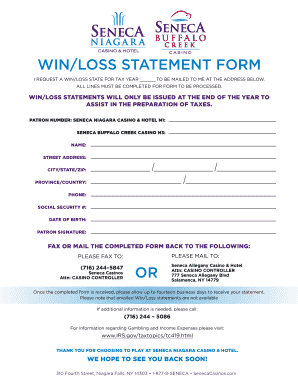

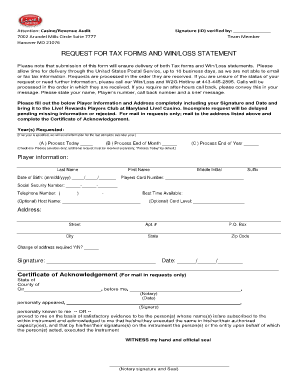

Notably, the win-loss statements reflect that petitioners had gambling winnings totaling $115,142, while the Forms W–2G provide that petitioners had total gambling winnings of $322,500 In other words, Judge Wherry relied upon casino win/loss statements to impeach the credibility of the taxpayers’ other evidence. Can I use a casino win/loss statement,to show my losses? Absolutely, just make sure it includes all wins and losses separately and is not a combined number. You should show your gambling winnings as income and then your gambling losses as an itemized deduction, if you qualify. The Win/Loss (Tax) Statement you will receive from your casino merely provides an unverified estimate of your slot and table game win/loss that you can use to compare to your own records and is not a substitute for the records you are required to keep under applicable State and Federal tax laws.

The feeling of stress and anxiety that comes when filing taxes can be overwhelming for anyone, but especially for casino players that hit slot jackpots or enjoy other high stakes gaming.

Everyone has a different opinion about how to file, and there are very few resources available that give gamblers peace of mind. That’s why I recently sat down with Ray Kondler of Kondler & Associates. Ray is a Certified Public Accountant based in Atlantic City and Las Vegas.

He’s also one of the top national experts on gambling taxes.

While Ray works closely with the World Series of Poker, he also serves slot and table players in all 50 states. In our fascinating conversation, Ray gave us the insider’s look at gambling taxes, keys for minimizing the chances of an audit, and tips for paying as little as possible… while staying within the bounds of the law, of course!

Here are the highlights from our great conversation. (You can also watch or listen to the full episode below.)

The First Thing Gamblers Should Know About Taxes

Want to protect yourself from an audit? Download our FREE Casino Player's Logbook to start keeping better records of your gambling activity.

Filing as a Professional Gambler

Gambling Win Loss Statement Taxes

How to Protect Yourself From a Tax Audit

Want to protect yourself from an audit? Download our FREE Casino Player's Logbook to start keeping better records of your gambling activity.

Win Loss Statement From Casino For Taxes

Comps and the IRS

Casino Win Loss Statement Taxes

Professional Help for Gambling Taxes

Casino Win Loss Statement For Taxes

Gambling Win Loss Statement Taxes

Want to protect yourself from an audit? Download our FREE Casino Player's Logbook to start keeping better records of your gambling activity.